CENTENE (CNC)·Q4 2025 Earnings Summary

Centene Q4 2025 Earnings: Revenue Beats but HBR Deterioration Weighs on Results

February 6, 2026 · by Fintool AI Agent

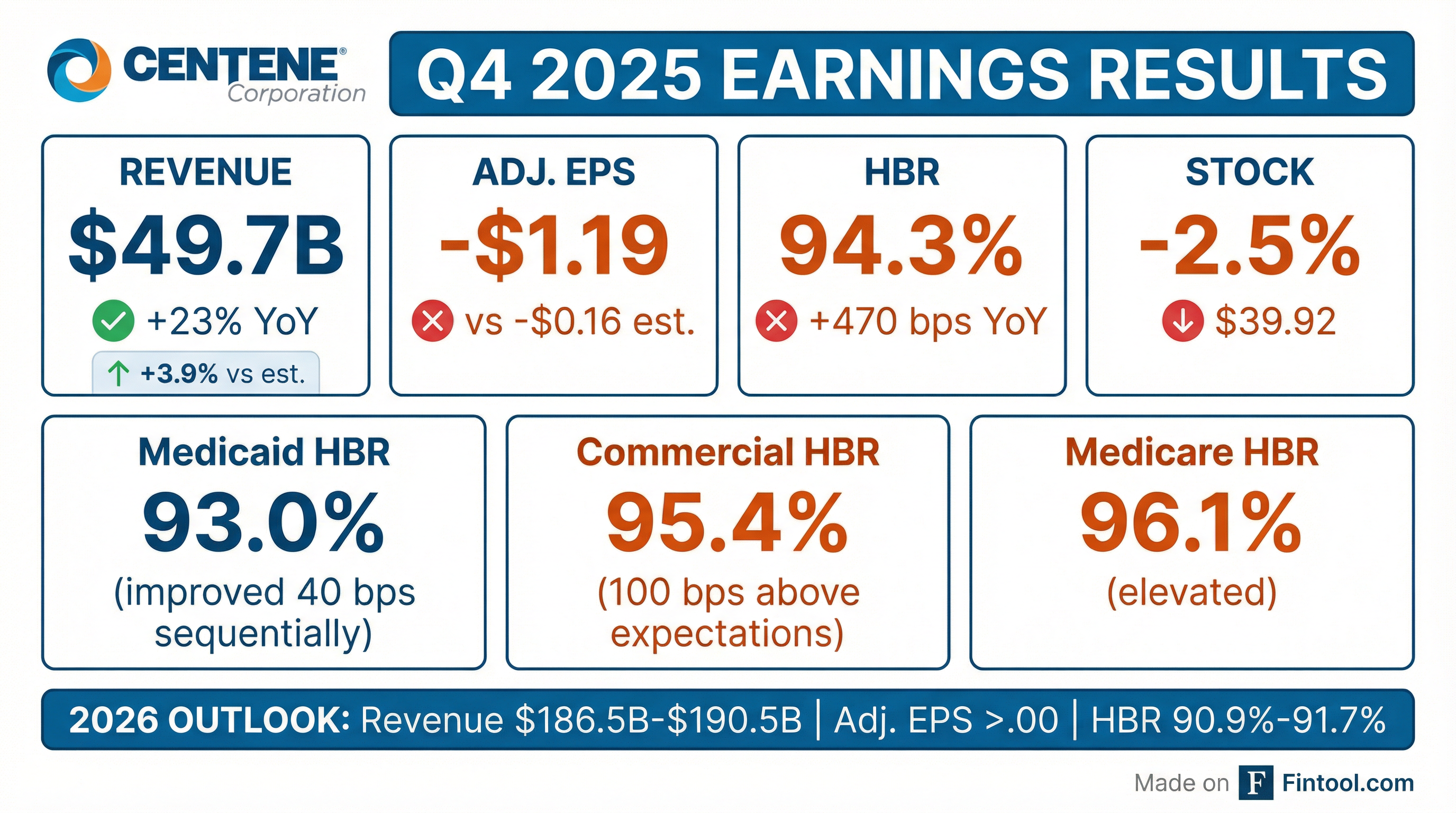

Centene Corporation reported Q4 2025 results showing strong revenue momentum (+23% YoY) but continued margin pressure from elevated medical costs across all segments. Revenue of $49.7 billion beat consensus by 3.9%, driven by robust Medicare PDP membership growth and Marketplace market share gains . However, the consolidated Health Benefits Ratio (HBR) of 94.3% came in well above expectations, with Commercial HBR at 95.4% — 100 basis points higher than anticipated due to out-of-period items . The stock fell ~2.5% on the day as investors weighed the margin headwinds against 2026 guidance calling for adjusted EPS greater than $3.00.

Did Centene Beat Earnings?

Centene beat on revenue but the profitability picture was challenged . The top-line strength was driven by:

- Medicare PDP growth: Premium yield and membership growth (+17% YoY to 8.1M members)

- Marketplace expansion: Overall market growth despite profitability challenges

- Medicaid rate increases: State-directed payments and rate actions

However, the bottom line was impacted by a $513 million impairment charge related to the pending Magellan Health divestiture, which closed in December 2025 .

How Did Each Segment Perform?

Segment Revenue Performance

Medicare was the standout segment with 75% revenue growth driven by the PDP business following Inflation Reduction Act changes . Commercial also showed strong 24% growth despite the profitability headwinds.

Segment HBR Analysis

The Medicaid HBR improvement of 40 basis points sequentially was a positive signal, reflecting rate increases and continued progress on cost management . However, Commercial and Medicare HBRs deteriorated significantly year-over-year due to higher morbidity and IRA program changes .

What Did Management Guide?

Centene issued 2026 guidance projecting meaningful margin improvement and a return to adjusted EPS growth:

The guidance implies a significant HBR improvement of approximately 250-340 basis points from the Q4 2025 level of 94.3% . Key drivers of the expected margin recovery include:

- Commercial HBR improvement of ~95 bps through pricing actions and network optimization

- Medicare PDP HBR increase of ~35 bps partially offset by Medicare Advantage improvement

- Medicaid rate increases in the mid-4% range

CEO Sarah London emphasized the path forward: "As we look to 2026, we are positioned to deliver meaningful margin improvement and renewed adjusted diluted EPS growth... marking important progress toward restoring the enterprise's embedded earnings power."

Risk Adjustment Positioning

For 2026, Centene anticipates being "in a meaningful payable position" for risk adjustment, a significant shift from the adverse development experienced in 2025 . The company worked with Wakely (independent actuarial firm) to support publication of a new marketwide report on "paid membership, metallic tier distribution, and statewide average premium" expected in late Q1 to help all market participants better calibrate risk adjustment assumptions

2026 Guidance vs Consensus

The revenue guidance of $186.5B-$190.5B came in below Street consensus of ~$192.5B, reflecting the company's deliberate Marketplace membership actions and membership attrition. However, the EPS guidance of >$3.00 is slightly above consensus of $2.99, demonstrating management confidence in margin recovery.*

*Values retrieved from S&P Global

What Changed From Last Quarter?

Key Developments

-

Magellan Health Divestiture Signed: In December 2025, Centene signed a definitive agreement to divest the remaining Magellan Health businesses, resulting in a $513 million impairment charge ($389 million after-tax)

-

Medicaid Stabilization: The Medicaid HBR improved 40 basis points sequentially to 93.0%, demonstrating progress on rate negotiations and cost management

-

Commercial HBR Blowout: The Commercial segment HBR of 95.4% was 100 basis points above expectations driven by out-of-period items and continued Marketplace morbidity challenges

-

Strong SG&A Management: The adjusted SG&A ratio of 7.4% for full year 2025 demonstrated continued expense discipline despite membership growth

-

Days in Claims Payable Normalization: DCP decreased to 46 days from 48 days in Q3, reflecting elimination of the Medicare Advantage premium deficiency reserve

Membership Trends

The total at-risk membership grew 7% YoY despite Medicaid redetermination headwinds and the loss of TRICARE eligibles (2.7M in Q4 2024, now zero) .

How Did the Stock React?

Centene shares fell approximately 2.5% on February 6, 2026, closing at $39.92 compared to the prior day's close of $40.96. The stock is trading near 52-week lows, down approximately 40% from its 52-week high of $66.03.

The muted reaction reflects:

- Revenue beat (+3.9%) was encouraging

- HBR deterioration and Commercial challenges continue to weigh

- 2026 guidance largely in-line with expectations

- Magellan divestiture provides simplification but at a cost

Full Year 2025 Summary

The full year GAAP loss was driven primarily by the $6.7 billion non-cash goodwill impairment recorded in Q3 2025 following the One Big Beautiful Bill Act and stock price decline . Adjusting for this and other one-time items, the company delivered adjusted EPS of $2.08.

What Did Analysts Ask About?

Q&A Highlights

On Medicaid Rates (Ann Hynes, Mizuho): Asked why 4.5% rate expectation wasn't higher given elevated trend. CEO London noted states now have "a full two years of both the acuity dynamics and the step-up in trend encapsulated in the data" for rate decisions. Importantly, 2025 rates matured favorably from initial expectations to 5.5% composite .

On Medicaid Trend (Justin Lake, Wolfe): Revealed 2025 trend was "mid-6s" declining to "mid-4s" net trend assumption for 2026. The improvement is driven by aggressive actions in H2 2025 plus "bankable proof points around actions that we took in Q3 and Q4 that don't take effect until 2026" .

On Marketplace Bronze Dynamics (Kevin Fischbeck, BofA): Bronze membership will represent "a little over 30%" of marketplace enrollment in 2026 vs 19-24% historically. Management noted Bronze products "operated differently pre-EAPTCs than they did during the EAPTC period" and they have that historical data to inform pricing .

On PBM Contract (AJ Rice, UBS): CFO Asher highlighted "tailored, transparent, and flexible contract" with their PBM partner, noting Centene benefits from "$60 billion of pharmacy spend and not owning our own PBM" — allowing maximum economic benefit from the arrangement .

Key Management Quote

CEO Sarah London set a high bar for Medicaid performance:

"If all we do is deliver a 93.7 in Medicaid, I will be very disappointed. And I know the team will too."

This suggests upside to guidance if trend management initiatives prove successful.

Segment Margin Targets Revealed

CFO Drew Asher provided specific 2026 margin expectations by segment during Q&A:

The elimination of the Premium Deficiency Reserve (PDR) for Medicare Advantage signals the business is "on the margin, not losing money" though still operating at a "slight loss on a fully allocated basis" .

What's Driving Medicaid Trend Improvement?

ABA Task Force Findings

Management detailed their Applied Behavioral Analytics (ABA) task force established in Q2 2025, analyzing data across their 29-state footprint. Key findings :

- Outlier providers prescribing maximum hours for every patient instead of individualized care plans

- Children in therapy for 5-10 years when clinical evidence suggests optimal duration is 2-3 years

- 40 hours per week of therapy prescribed instead of balanced school-integrated care

- Lack of appropriate oversight of registered behavior technicians

The multi-pronged response includes direct provider engagement, network optimization, state partnerships on program design, and ABA-specific member/parent engagement programs led by PhD-level board-certified behavioral analysts .

No Surprises Act Litigation

Management is taking a "more aggressive litigious posture" on NSA abuses. This week, Centene filed a multimillion-dollar lawsuit against a New York provider alleging "fraudulent manipulation of in-network and out-of-network claims" .

AI and Technology Initiatives

CEO London highlighted investments in AI and automation:

"We currently score our claims data against 75 different algorithms designed to triangulate potential fraud. Alerts are triggered and sent to a group of cross-functional experts for immediate review and intervention."

For 2026, Centene is "accelerating integration of agentic capabilities into core operations to drive automation and efficiency" across prior authorization, call centers, member navigation, and payment integrity .

Key Risks and Concerns

-

Marketplace Profitability: The Commercial HBR of 87.9% for full year 2025 (vs 77.3% in 2024) indicates persistent morbidity challenges that must be addressed through 2026 pricing actions

-

Medicaid Rate Adequacy: 2025 trend ran "mid-6s" with only "mid-4s" rates expected for 2026 — management is targeting flat HBR but acknowledged disappointment if that's all they achieve

-

Medicare 2027 Advance Notice: Last week's CMS advance notice "suggests a more pressured view of rates than industry expectations" which "will likely cut into seniors' benefits and product selection"

-

Bronze Product Risk: With bronze now 30%+ of marketplace membership (vs 19-24% historically), there's execution risk if utilization patterns differ from pre-EAPTC experience

-

No Surprises Act Costs: Out-of-period NSA costs pushed Q4 Commercial HBR up ~100 bps; management added accruals for 2025 dates of service and incorporated 2026 NSA costs in guidance

2026 Earnings Seasonality

CFO Asher provided explicit quarterly guidance on earnings distribution:

"We expect the majority of 2026 adjusted EPS in Q1, stepping down in Q2, and further to around break-even in Q3 with a loss in Q4."

This seasonality is driven by Marketplace and PDP benefit designs, both with lower HBRs early in the year as deductibles reset and higher HBRs later as members exhaust cost-sharing limits.

2026 Membership Outlook

The Marketplace decline from 5.5M to 3.5M reflects the expiration of enhanced APTCs and mid-30s% pricing increases designed to improve profitability . Through end of January, "paid rates, while below historical levels, are right in line with our expectations in a post-EAPTC environment" .

Forward Catalysts

- Q1 2026 Earnings (late April): First read on 2026 margin trajectory — expect majority of full-year EPS

- February Marketplace Paid Membership: Final effectuation of post-EAPTC enrollment

- Magellan Health Divestiture Closing: Expected to provide strategic simplification

- April 2027 Medicare Rate Final Notice: Finalization of disappointing advance notice

- State Medicaid Rate Negotiations: Ongoing discussions with "two years of acuity data" now available

Sources: Centene Corporation Q4 2025 earnings release, earnings call transcript, 2026 guidance presentation, company filings. Market data as of February 6, 2026.